"Sri Lanka has set ambitious targets for economic growth and development, our growth story is unique encompassing the cultural richness of a beautiful heritage and the innovative and global outlook of the Modern Sri Lankan"

-

Sri Lanka’s recent history has been marred by a devastating civil war, however with the end of war in 2009, the state of the country has improved considerably and the economy too is back on track.

Mediocre performance in the 80s and 90s

After witnessing a rather average performance throughout the 1980s and 1990s, mainly due to the Sri Lankan Civil War, the Sri Lankan economy saw growth after the signing of the ceasefire agreement in 2001. The Colombo Stock Exchange (CSE) then witnessed unprecedented growth as the All Share Price Index (ASPI), which was hovering around the 500 mark in August 2001, surpassed the 2000 mark.

In 2007, bolstered by improved investor confidence as a result of favourable political developments and strong corporate results, the CSE recorded its highest point as the ASPI passed the 3,000 mark for the first time in its history.

A brand new era

Then a brand new era dawned over the entire island, as the civil war which had held the island nation in its deadly grasp for over 25 years finally ended in May 2009. The end of the war is widely regarded as the single most significant event in Sri Lanka's recent history since its independence from British rule in 1948.

Back on track

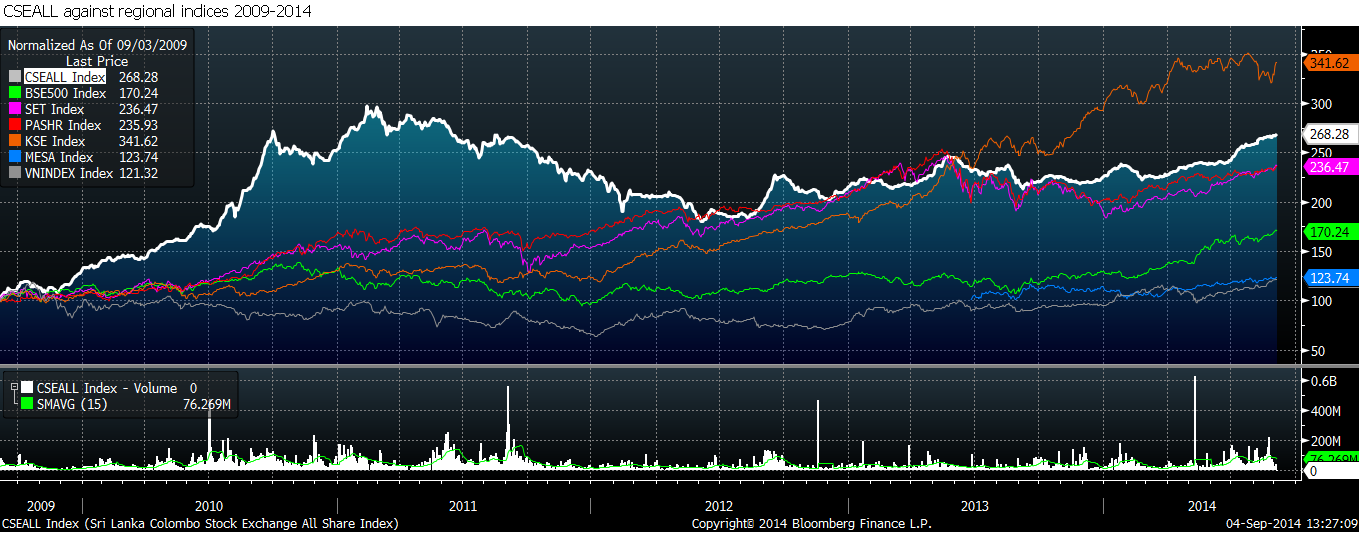

Since 2009, the CSE has had a bull run unmatched by most other markets, generating on average an annual return of 25%. As at 2014H1, the CSE had listed on it 295 companies covering 20 sectors, with a market capitalization of approximately USD22bn.

Given the bourse's unprecedented growth levels, Bloomberg named it one of the best-performing stock markets in the world for the years 2009 and 2010.

Improved economic sentiments

The Sri Lankan economy is on the rise, fuelled by a comprehensive fiscal and monetary policy, mega infrastructure investments, Sri Lanka’s emergence as a tourism and transhipment hub and a mushrooming middle class.

The Colombo Stock Exchange (CSE) trades at a discount compared with most of its regional peers, despite the country being one of the fastest-growing economies in the world. The index's current valuation of 12.8x is at a 22% discount to its regional peers with attractive forward valuations.