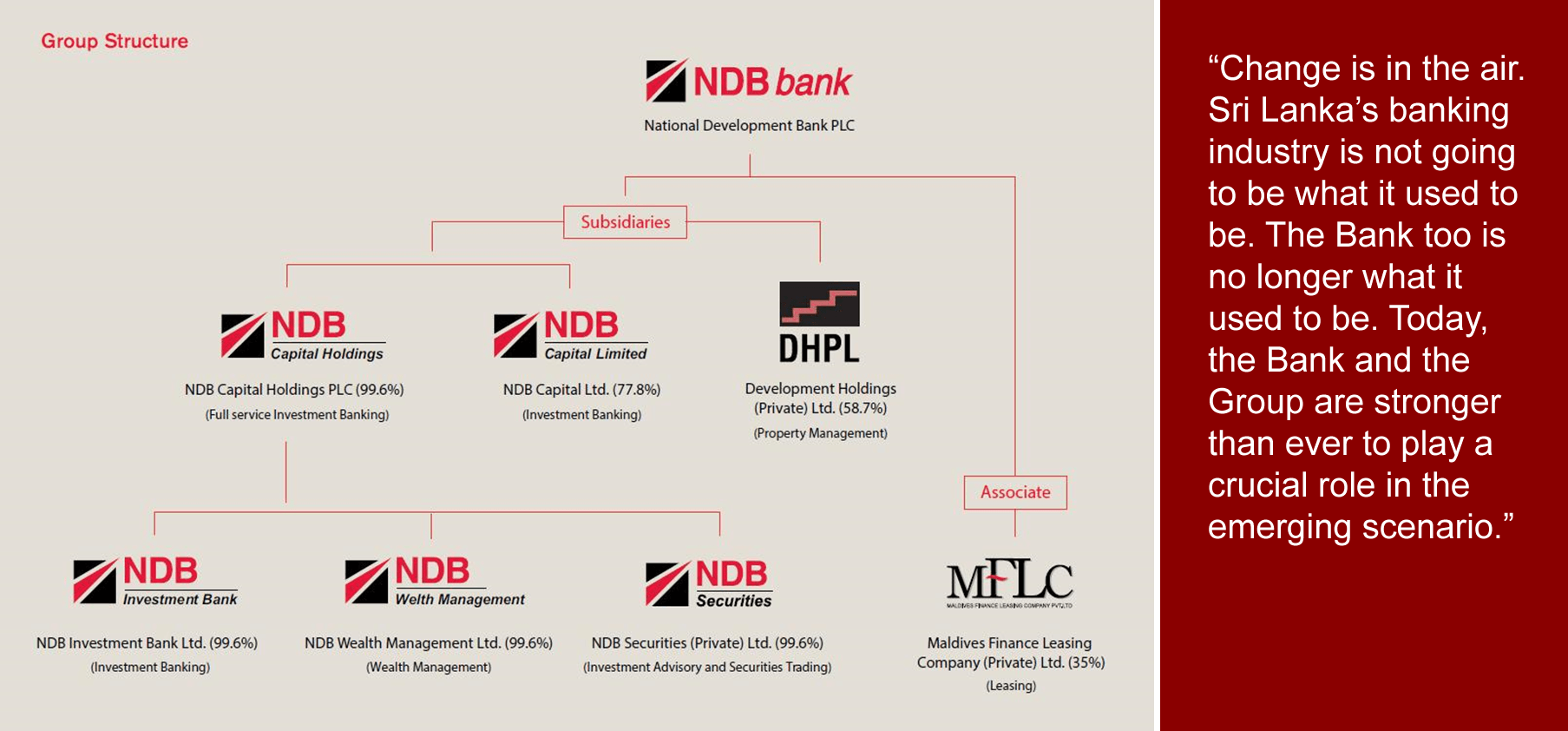

National Development Bank PLC

| VISION | To be a world-class Sri Lankan bank. |

| MISSION | To be dominant in the financial services sector, creating superior long-term shareholder value and contributing to economic development in Sri Lanka by exploiting regional opportunities and delivering innovative solutions with 'best in industry' service excellence through an inspired team. |

| VALUES |

|

Commencing business as a traditional development finance institution over three decades ago, the Bank subsequently diversified and transformed itself into a successful Licensed Commercial Bank in 2005. Notwithstanding the change in legal form, it is an institution that did not abandon its roots. Rather, its development banking heritage provided the required synergy and an edge over its peers in the commercial banking space.

Subsidiaries

NCAP provides full service investment banking services, comprising both fund and fee based activities such as debt and equity raising, corporate advisory, mergers and acquisitions, stockbroking, wealth management, private equity and underwriting. The fee based services are carried out via subsidiaries of NCAP whereas fund based activities are performed directly under the Company.

Directorate :

- Mr. Ashok Pathirage (Chairman)

- Mr. Senaka Kakiriwaragodage

- Mr. Dimantha Seneviratne

- Mr. Arjun Fernando

- Mr. Sarath Wikramanayake

- Mr. Ananda Atukorala

- Mr. Bernard Sinniah

|

|

The Future:

NCAP hopes to float Sri Lanka's first dedicated private equity country fund (subject to receiving all regulatory approvals). In addition, NCAP is currently in the process of improving synergies with the Investment Banking Cluster and with the Bank's core banking operations.

Incorporated in 1995, NDB Capital Limited is a Sri Lanka-Bangladesh joint venture and a subsidiary of National Development Bank PLC of Sri Lanka. NDB Capital provides a wide range of Investment Banking services in Bangladesh. It is a full-fledged Merchant Bank licensed by the Bangladesh Securities and Exchange Commission.

|

|

|

The Future:

NDB Capital hopes to carry out the first ever Islamic Bond (Sukuk) in the country’s capital market. Building on its successful track record in 2013 and strong deal pipeline, NDB Capital also plans to establish itself as the leading investment bank in Bangladesh.

DHPL is engaged in the business of renting out a 15-storied high rise commercial property in the heart of Colombo, popularly known as the NDB - EDB tower situated in Navam Mawatha, Colombo 02.

Associate

Maldives Finance Leasing Company Private Limited was set up in 2001 and commenced operations in June 2002. It provides finance leases to small and medium scale business enterprises in the Maldives. The company's technical partner is the National Development Bank of Sri Lanka.