- Value-driven investment philosophy

- Formidable expertise in various asset classes

NDBS is able to deliver exceptional levels of performance, ensuring all unit trust investments are value-driven and firmly research-based.

Our knowledgeable investment advisory team is poised to support all your varying wealth planning needs in multiple asset classes including equity, fixed income and money markets.

-

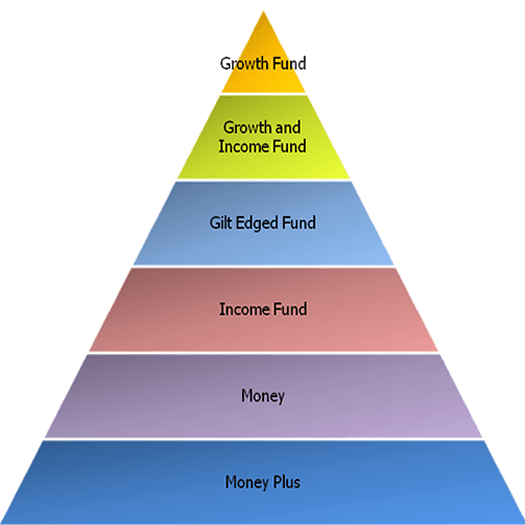

Types of Funds

Unit trusts can be broadly classified into two types - Open-ended and Close-ended funds

Unit Trust Fund Classifications

Gilt-edged Funds are funds which invest only in Government Securities. Treasury Bills, Treasury Bonds and Repurchase Agreements on Government Securities are the only instruments in which these funds make their investments. The risk level on these funds remains very low and the returns on these funds are marginally lower than the rate on return on bank deposits. These funds are ideally suited for investors who do not want to take any risk on their investments. These funds regularly pay out a dividend either on a quarterly, semi-annual or annual basis.

These funds will invest in equity securities in the same proportion of each security's representation in a particular price index. The index can be S&P SL20, where the fund will invest in the 20 companies that are included in the S&P SL20 index according to the proportion each of these 20 companies represent in the index. The Fund Management Company can select a group of stocks and create an index for these stocks and confine their investments to these stocks. The main objective of the fund is to replicate the performance of the selected index. For example, if we say that the S&P SL20 index has grown by 20% in a given period, the indexed fund that track the S&P SL20 should also grow by 20% during the same period. The risk level of these funds is marginally below the risk level of growth funds.

These funds invest in fixed income securities that provide a much higher return than the Treasury Bills and Bank Deposits. Major part of the investments of the funds is made in corporate debt securities yielding higher returns. These funds also make investments in Treasury Bills, Bank Deposits and Repurchase Agreements. Investors in these funds get a regular dividend from the fund, either semi-annually or annually.

Balanced Funds have an objective of providing the investors with a regular return and a capital appreciation in the medium to long term. The investments of the fund are made in equity securities and fixed income securities. The proportion of investments in equity securities and fixed income securities can vary depending on the market conditions and the investment strategies of the Fund Managers. These funds generally pay out a dividend once a year and investors can expect a capital appreciation in the unit prices in the medium to long term. These funds are ideally suited for investors who are seeking a regular return and who are willing to take a moderate risk for capital appreciation in the medium to long term. Usually these funds charge an entry fee when new investors enter the fund.

These funds have an objective of providing a capital appreciation in the medium to long term. Major part of the investments of the fund is made in equity securities with a smaller portion of funds in fixed income securities. Here the Fund Manager will make investments in shares of the companies that are expected to grow their earnings in the medium to long term. Investors in these funds can expect a return higher than the rate of inflation in the medium to long term. Similarly the risk level of these funds is higher than the Balanced Funds. These funds may not pay a regular dividend to the investors but the investors have the option of selling their units back to the Fund Management Company if they feel that they are happy with the growth and they want to realize the capital appreciation.

Money Market Funds are funds which invest in short term fixed income securities such as, Treasury Bills, Bank Deposits, Commercial Papers, Asset Backed Securities and Repurchase Agreements. These funds are ideal for individuals as well as corporates to park their temporary cash surpluses and earn a competitive tax free return. These funds generally provide liquidity similar to a savings account with a very attractive return. Investors can keep their investments even for a shorter period and earn a return. Investors in these funds are paid one or more dividends per year.

These funds can be confined to equity securities of a particular sector. For example, the Banking Sector, the Manufacturing Sector etc. For example, if the fund is a Banking Sector fund, the investments of the fund will be confined to the equity securities coming under the Banking Sector. The Fund Manager need not invest in all the companies that come under the particular sector, he can select the best companies out of the sector and invest. The Fund Manager takes a view that during certain periods certain sectors will do well and offers that opportunity to the investors to take advantage of it.